- Health Distilled by Liverpool Lane

- Posts

- Venture-backable startups, healthspan, nurses.

Venture-backable startups, healthspan, nurses.

Healthcare through a Kentucky lens. It's niche. But neat!

🥶

Unplanned VC data synergy

“Louisville doesn't lack venture capital. It lacks venture-backable startups.”

That’s a quote from KYX’s The Distill newsletter on January 19, 2026. I 💯 concur.

It reminded my of this tweet from 2014. Similar vibe.

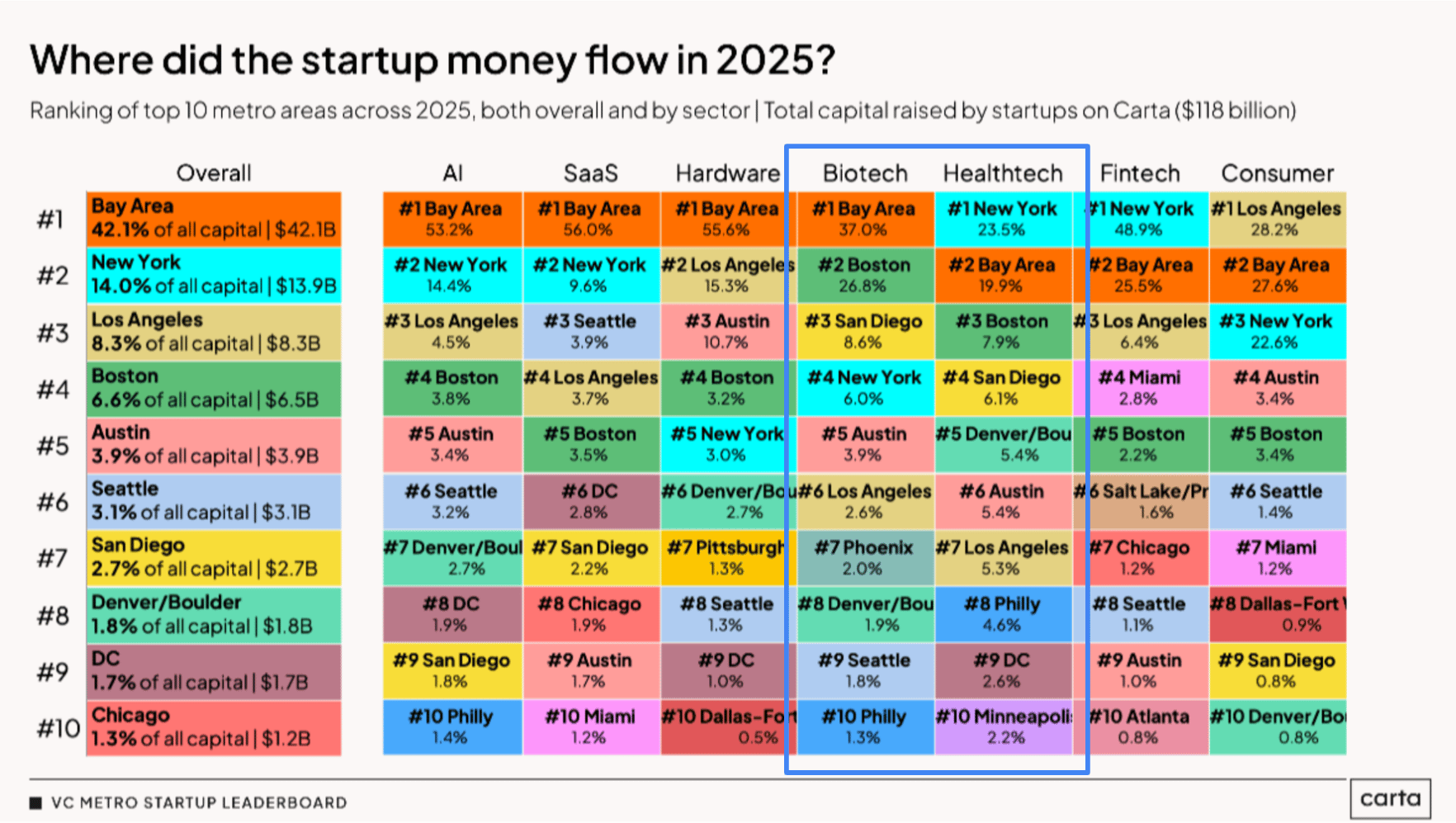

On to data from Carta. Remember, I love Carta data. Top 10 metros for biotech and healthtech startup funding in 2025. A lot of overlap in those rankings.

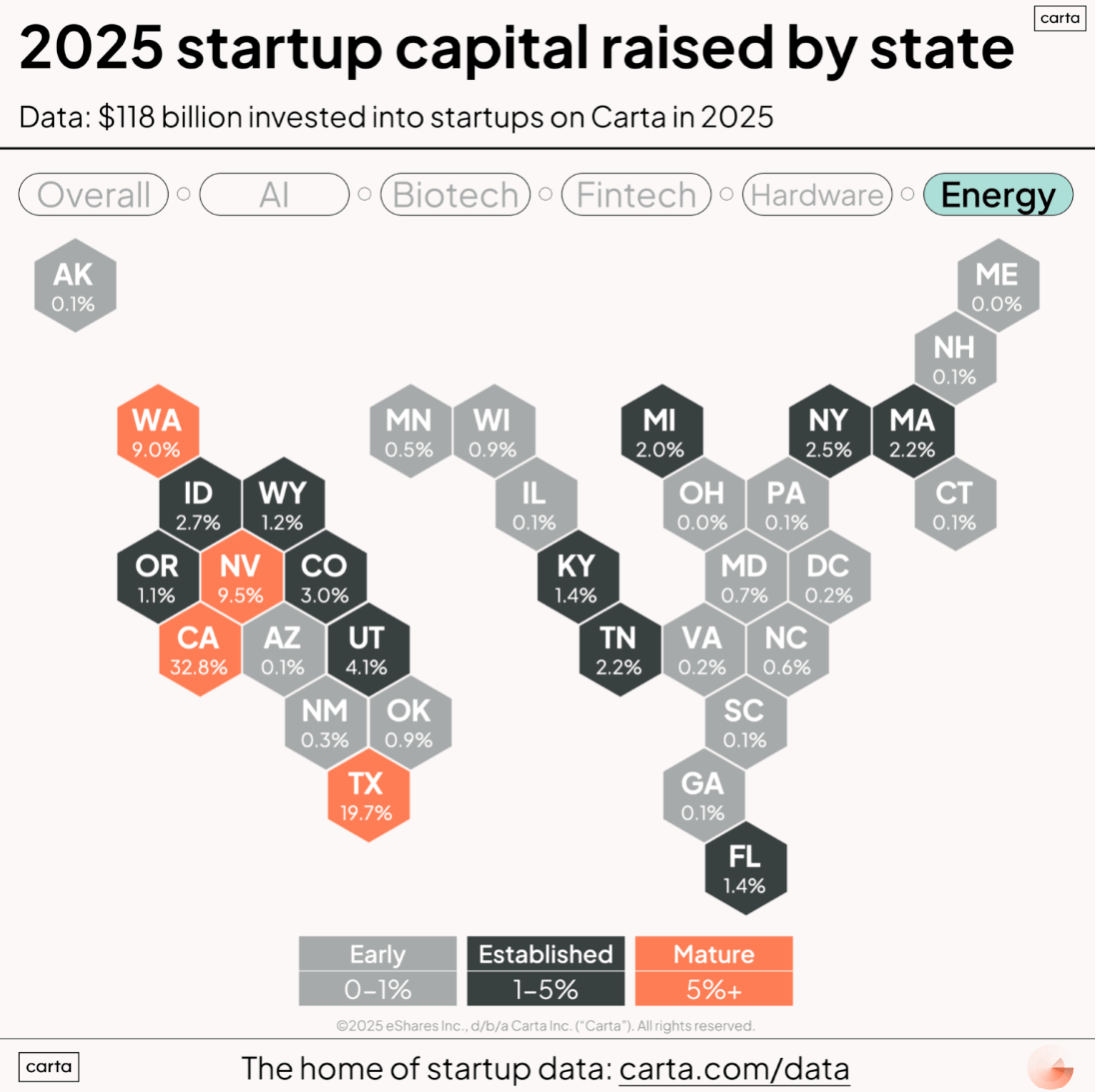

I stopped the scroll on this GIF on energy. Why? Because KY shows up here as “Established: 1-5% of capital.” Overall 0.1%. Biotech 0.0%.

Is KY not on these lists because we lack venture capital? Or because we lack venture-backable startups? Dog, it’s the latter.

Biotech (or biopharma)

Louisville is not the next Kendall.

Elsewhere in the report you can read that the “average seed round for Massachusetts companies was $8.1 million.”

Healthspan (the artist currently and formerly known as longevity)

Two recent pieces of note.

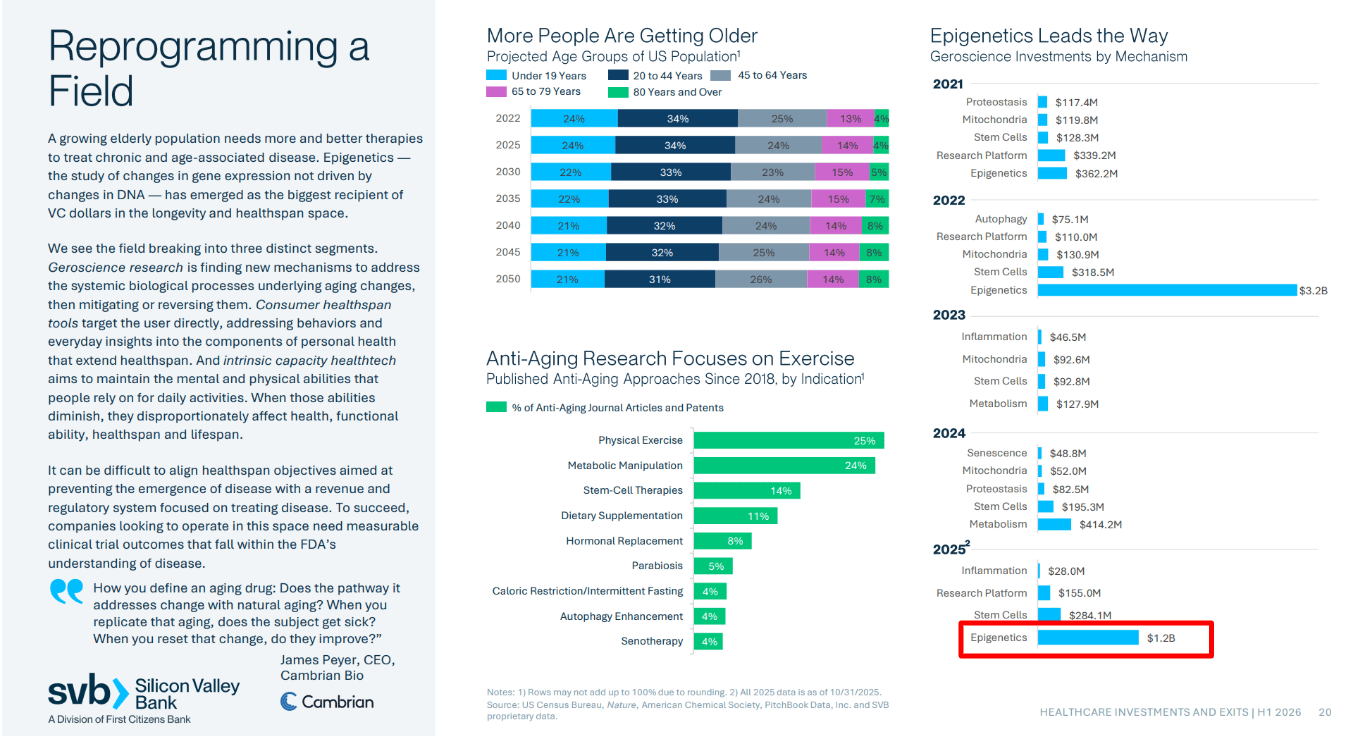

First, SVB’s Healthcare Investments and Exits H1 2026 report. Epigenetics has emerged as the biggest recipient of VC dollars in the longevity and healthspan space. Lexington, KY-based TruDiagnostic bills itself as “The Epigenetic Company.” So that’s cool.

The SVB report states that “just three deals account for the vast majority of [healthspan] investment.”

Enter Bailey & Company’s 2026 J.P. Morgan Healthcare Conference Recap.

Like “value-based care” five years ago, “longevity” is both buzzy and somewhat nebulous as a concept, with market discovery still to come around which revenue models are most likely to underpin sustainable businesses.

Broken record, but our Commonwealth should be able to play in the healthspan space. We have some assets.

Like, what if Louisville and UK’s Sanders-Brown Center on Aging bonded over aging and healthspan, just as an example?

Nurses

This article from Nurse Capital bears resharing.

“At Nurse Capital, we believe nurses aren’t just bedside caregivers, care managers or primary health care providers, they are the untapped architects of scalable, high‑impact healthcare solutions.” Again, I 💯 concur.

A probably non-exhaustive list of nurse-founded startups just in Louisville:

PAC-IQ (acquired by Direct Supply in 2024).

Put a bow on it.

Thanks for being part of this community. It means more than you probably realize.